Groupon Inc (NASDAQ:GRPN disclosed in its latest filing with the Securities and Exchange Commission (SEC) that one of its senior executives decided to leave to take a new position in another technology company.

Jeffrey Holden, senior vice president of product management at Groupon Inc (NASDAQ:GRPN) will step down from his position effective March 18, 2014.

Groupon spokesperson, Bill Roberts said Holden will join a non-competitor company, and his responsibilities will be distributed by other members of the daily deal company’s team. Some insiders said Holden will be moving from Chicago to the Bay Area to work with a startup company.

Holden joined Groupon Inc (NASDAQ:GRPN) after Pelago, his startup company was acquired in 2011. Pelago was developed Whrrl, a location-based service app similar to Foursquare. He previously Amazon.com, Inc (NASDAQ:AMZN).

A few weeks ago, Groupon’s HR chief Brian “Skip” Schipper resigned to join Twitter Inc (NASDAQ:GRPN).

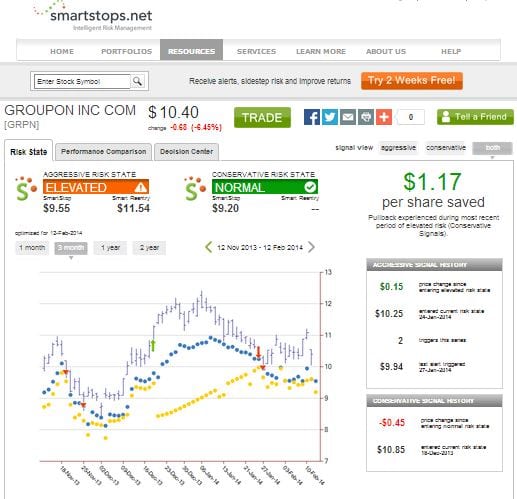

The report regarding Holden’s departure sent the stock price of Groupon Inc (NASDAQ:GRPN) lower by more than 6% to $10.40 per share today.

Analysts’ reactions

Ross Sandler, analyst at Deutsche Bank AG (USA) (NYSE:DB) initially described the departure of Holden as a “potential red flag,” but changed his perception later and called it a “natural evolution for the company.” According to him, he changed his opinion after learning additional information regarding Holden’s resignation.

Sandler added that the sell-off in the shares of Groupon Inc (NASDAQ:GRPN) was over reaction. He maintained his Buy rating for the stock and emphasized that the company has other talented executives. Furthermore, he believed its recently acquired flash-sale retailer, Ideeli could boost its profitability.

On the other hand, Sterne Agee analyst, Arvind Bahatia noted that the daily deals company is improving its business to become a one-stop destination for bargain hunters, and it is not only offering promotions for restaurants, spas, and gyms. According to him, Groupon Inc (NASDAQ:GRPN) is now selling different products including iPhone chargers and televisions as discounted prices, and it is offering free coupons from local and national retailers. He said the company has a turnaround potential and he maintained his Buy rating for the stock.

Equity risk state

Some investors received everyday alerts from investment risk monitoring firm, Smartstops.net when the stocks in their portfolio entered a conservative or aggressive risk state. The firm uses risk management algorithms designed to calculate the normal trading range of stock for each trading day, and identify price points that fall outside of the expected trading range. Once the indicated price point is reached the stock enters elevated risk. Currently, the shares of Groupon Inc (NASDAQ:GRPN) risk level is elevated. It entered the current risk state when it first traded at $9.94 per share last January 27. Generally investors who pulled out their investments after receiving exit triggers from Smartstops.net save money.