One of the most used indicators of residential real estate prices in the U.S. is the Case-Shiller Home Price Index (CSHPI). The index is based on repeat-sales data, which monitors how individual homes’ prices change over time. Compared to other indices that depend on median or average sales prices, this enables a more accurate and thorough understanding of the housing market. We will examine a few benefits of the Case-Shiller Home Price Index.

They are Timely and Accurate

The accuracy of the Case-Shiller Home Price Index is one of its main benefits. To determine home prices, the CSHPI employs a sophisticated methodology that examines sales prices for the same properties over time. This method aids in removing some of the distortions that may appear when comparing home prices between various areas or types of residences. The CSHPI offers a more precise indicator of the fundamental changes in home prices because it keeps track of the same properties over time.

The Case-Shiller Home Price Index’s timeliness is another benefit. Investors, analysts, and decision-makers can easily access the most recent data on housing market trends because the CSHPI is regularly released—typically once a month. In times of economic uncertainty, when policymakers and investors must act quickly based on the most recent information available, this timeliness can be especially helpful.

The Case-Shiller Home Price Index is valuable for various stakeholders due to its accuracy and timeliness. The CSHPI, for instance, can be used by homebuyers to monitor price alterations over time and gain insight into the state of the housing market. Investors can use the CSHPI to spot potential real estate investment opportunities and policymakers to track economic trends and inform decisions about housing policies.

They are Widely Accepted

One of its main advantages is the Case-Shiller Index’s ability to track housing market trends over time precisely. Unlike other measures that rely on more constrained data sources, the index is based on repeat sales of the same properties, enabling it to provide a more accurate and trustworthy picture of changes in home prices.

Another benefit is the Case-Shiller Index’s capacity to provide data on housing market trends at the national, regional, and local levels. It makes it an essential tool for investors and decision-makers who need to know how the housing market is doing across the nation.

The Case-Shiller Index helps predict future housing market trends. Analysts can predict how the market will likely behave by analyzing historical data and spotting patterns and trends. As a result, homebuyers and sellers may be better equipped to decide when to buy or sell a home.

Due to its extensive use, the Case-Shiller Index has also gained widespread acceptance as a benchmark for determining housing market trends. It implies that consumers and investors are more likely to trust it, which can contribute to more stability and confidence in the housing market.

They Offer a Long-term Viewpoint

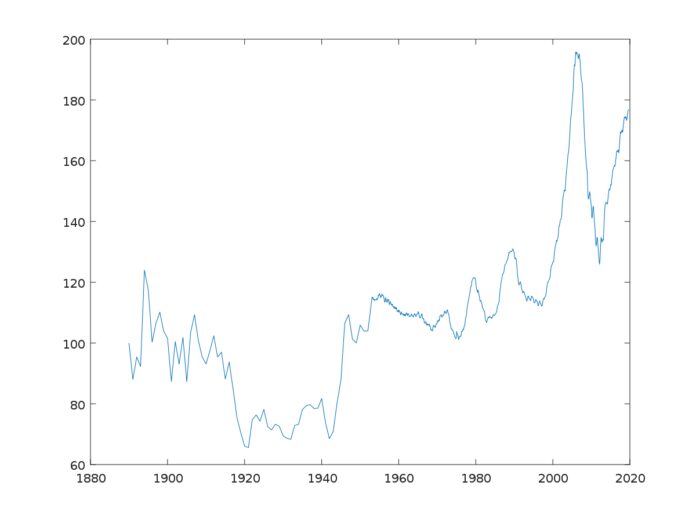

The Case-Shiller Home Price Index gives investors and decision-makers a long-term perspective on housing prices. The index allows analysts to track the residential real estate market’s performance over a considerable time because it spans more than 30 years. It aids in the informed decision-making of both investors and policymakers regarding the purchase or sale of real estate assets.

Unlike other indicators like asking prices or appraisals, the index is based on actual sales prices, which provide a more accurate representation of home prices. The index uses repeat sales data, allowing it to track individual property prices over time as opposed to the prices of various homes in the same neighborhood. It gives a better picture of the trends in housing prices in a specific market.

Also, the index offers a standard by which different properties can be measured. For instance, it might be a sign that a property is overvalued if it sells for more than the index suggests it should be worth. In contrast, it might indicate that a property is undervalued if it sells for less than the index suggests it should be worth. The index is well-known and respected, so real estate experts, investors, and decision-makers use it. It is a helpful tool for those interested in the residential real estate market.

They are Relevant to Policymakers

The CSHPI is, first and foremost, a reliable gauge of the state of the housing market. Policymakers can use this data to track housing market trends and spot potential dangers or imbalances. The Case-Shiller Home Price Index also offers policymakers a long-term view of the housing market, another benefit.

Policymakers can use this historical data to spot patterns and trends in the housing market and inform their current policy choices. Since it is well known and respected within the industry, the CSHPI is a helpful tool for policymakers for they can feel secure knowing that the CSHPI is based on a reliable methodology and is well-liked by industry players.

They Reflect Market Principles

The Case-Shiller Home Price Index’s rigorous methodology considers an extensive range of market factors. It is determined by tracking the prices of individual properties sold over time using a repeat sales approach. Instead of just measuring the average price of all the homes in a particular area, this enables the index to capture changes in the value of homes.

The Case-Shiller Home Price Index can capture shifts in market fundamentals that can significantly impact the overall state of the housing market by concentrating on changes in the value of homes over time. For instance, the index will show an increase in home prices over time if a sudden increase in housing demand exists in a specific area. The index will also reflect changes in home prices over time if a change in economic conditions impacts the housing market, such as a recession or an increase in interest rates.

The Case-Shiller Home Price Index is a reliable and practical tool for monitoring changes in the value of the residential real estate in the United States. It is a valuable tool for homeowners, real estate investors, and policymakers because it emphasizes market fundamentals and rigorous methodology.