Often technological change is associated with smartphones or the famous “disruptor” apps, which have decimated certain industries while creating new ones out of thin air. But sometimes technology makes a quieter but extremely meaningful contribution to an important sector that goes relatively under the radar — the way credit unions have adopted board portal technology is one such example.

Here is the story of how credit unions recognized great benefits by quickly adopting this technology.

A Tool to Keep Evolving

Credit unions have been in a transformational period due to broad economic changes, and board portal software has helped them adapt to the change. Many mid-size community banks are disappearing, and credit unions, with their local focus, are replacing them. As credit unions expand in influence and adopt more physical locations across the country, their need for greater communication increases.

No matter how spread out directors may be, board portal software facilitates greater communication before, during and after board meetings. You can read this for more information about what features and training or support offerings separate basic board portal software from the highest-grade apps.

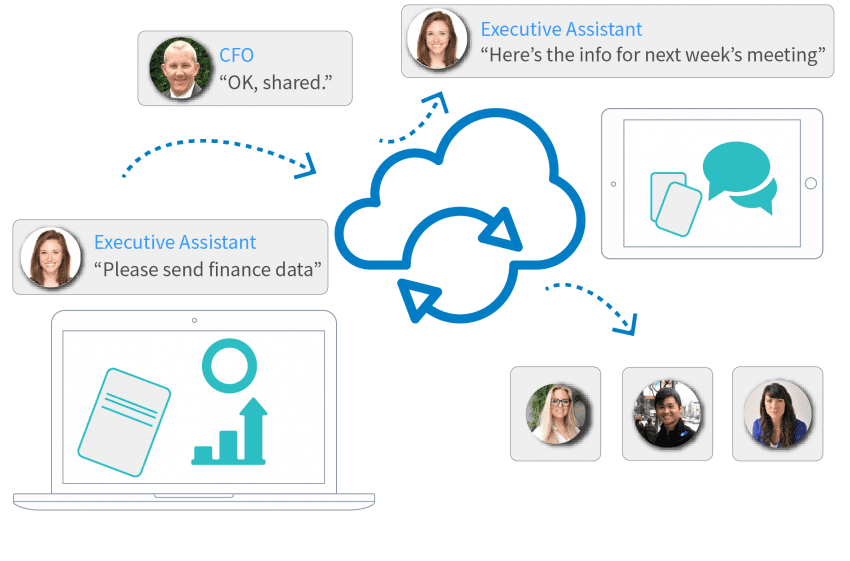

Communications Beyond Chatting

Board portal software lets credit unions do a lot more than just text: it facilitates full-on digital collaboration that fosters both better governance and more transparency. Directors will find it easy to not only share documents but leave comments in the margins, provide feedback or ask questions.

Any time a director makes changes to a document, they can be kept private or can be shared with others. This means your decision makers are kept abreast of changes automatically and right away so that no time is ever wasted bringing everybody up to date.

Simple Communications

Board portal software is cloud-based technology, designed to bring modern simplicity and increased organization to boardrooms. When using this technology, all communication takes place within one platform, so directors never have to bounce back and forth between emails and texts. But at the same time, directors can access this one platform on whatever device they’re most comfortable with — smartphone, tablet, laptop, or computer. Distributing board materials or compiling quarterly material has never been easier.

When directors need to make decisions quickly, the Board Administrator can issue a vote for directors to participate in and immediately see where the board stands. All of the board’s prior information, like past meeting minutes and reports, will always be available, and the app can be used online and offline, ensuring that directors always have full access.

The leaders of credit unions have found board portal software to be an indispensable tool for making communication easy and intuitive, and all at an affordable price point.

Credit unions need technology that empowers them to improve governance and communications among board directors — having software that contributes to faster and better decision making, increased transparency, and greater diversity of discussion at meetings has helped credit unions as they adapt to broader economic changes. Many credit unions were wise to adopt this technology early on, and as industries continue to evolve and the need for efficient tools only increase, board portal technology is likely to play an important role for credit unions for years to come.