Your death is not a subject you like to think about. However, it is an event that must be planned for. This is especially true if you have property or a large, high net worth estate. In the latter instance, you will need to ensure that your assets and money are divided in a way that reflects your wishes. And if you want to give financial support to a family member or other individual, you can establish a tax-friendly legal instrument to do so. If you are interested more about this topic and, visit milehighestateplanning.com.

The Difference Between a Will and a Trust

A will is a legal document that designates the people who will inherit your property when you are gone. If you do not have a will at the time of your death, your estate will be intestate, and a probate judge will decide how most of your assets are divided. Such a process can be long and contentious. Probate cases tend to divide families—sometimes bitterly—and can cost your heirs excessive amounts of money. To avoid this possibility, you should make out a written will that clearly states who you want to get what.

There is no such thing as a verbal will in the state of Colorado. Even if you tell a friend or a close family member how you want your property divided, it will hold no legal bearing until you put it in writing. You should hire an estate planning lawyer to set your will down in language that is incontrovertible.

Once your will is written, it must be signed in front of two witnesses. The testator (the originator or writer of the will) and the witnesses must be in the same room, and the testator must see the witnesses sign the will. You must also bring in a notary, who must be in the room as well. If you decide to change or update your will from time to time, the court will in most cases accept the most recent iteration.

Wills are not only useful for expressing your desire for how your property is to be divided when you pass. You can also create a living will to regulate your medical treatment should you ever be in a situation in which you cannot make your own decisions. You never know what life will throw at you. A bad accident or the onset of severe illness can leave you incapacitated. You can make a living will that stipulates the care you want to receive. Your will can also designate a trusted friend or family member to make medical choices on your behalf and can also include a Do Not Resuscitate Order (DNR).

Working with wills and trust attorney can help you decide the kinds of wills you want and what you desire to put in them.

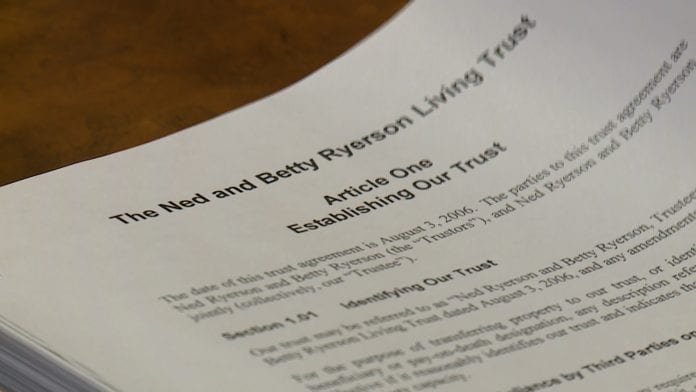

Trusts

It is a fiduciary relationship that involves one party, the trustor, giving another party, the trustee, the power to hold and manage assets for the good of a third party, the beneficiary. It is legal instruments designed to protect the trustor’s assets from burdensome tax. It can be designed in many ways. You can even use a it to form a public limited company that you run for your own benefit or that of another person. If you have considerable assets, you should consider creating trusts as part of a larger estate planning process.

You can create one for a loved one to help them through school and give them a good start in life. You can create certain conditions as to when the money from the trust is to be distributed and how it is to be used by the beneficiary. The trustee will have the power to ensure that all such conditions are met.

Indeed, it is important to choose the right person to serve as trustee. Trusteeship is a legal and binding obligation. Trustees are responsible for the oversight and management and can be held liable if the fund dries up before the beneficiary gets the money or one of the conditions is not satisfied.

Some people create trusts to preserve assets in case long-term medical care is needed. This is called a living or testamentary. If you have taken ill and need permanent care, you can transfer assets into a trust for your own benefit. The money in it will be used to pay for all expenses related to your care. If your condition affects your cognitive ability, you can designate a trusted friend or family member to act as trustee. Doing so will protect you against fraud and abuse. Once you have passed away, the money will be transferred to the beneficiary that you have designated.

The Importance of Estate Planning

Estate planning involves the creation of wills and other directives that will give your family clarity in the event of your death or incapacitation. The greater your assets, the more important is it for you to develop a sound estate plan.

If, for example, you have built up a large business and have selected the people you want to succeed you, it is important to write this down in your will. Creating a will gives the people you trust to maintain control of operations while giving your family fair proceeds from the financial success of the business.

A will is also important when it comes to high-value family heirlooms. Sometimes it is not property and shareholdings that are hotly contested, but jewelry, libraries, and other items that have been in the family for generations. If you have current custody of these things, you should create a will that designates who is to receive them after your death.

State and federal tax are also pressing issues. You will need to plan if you are to minimize the burden of estate tax on your family. You will also need to establish the right kind of trust if you want the beneficiaries to get the most from it.

Working with an estate planning lawyer while you are still of sound mind and body is the best way to create wills and trusts that reflect your values and intentions.