What if someone tells you that you do not have to pay an amount of your tax or you can get some amount back? Sounds profitable, right? Well, it’s also realistic and depreciation is somewhat similar to this. To put it simply, it will allow you to get some tax relief and deductions.

Depreciation

It is the process through which you can get rid of some payable tax amount by showing that the value of your asset will decrease over time. It is especially beneficial for property investors.

For example, you bought a house or a commercial building as an investment. The value of the property at this time is around 5 million. However, over time, the property will be used. Therefore, whether it’s an apartment building, a house or a commercial plaza, it will deteriorate. Thus, its value will also decrease.

For instance, you bought an apartment building and rent it out. Your tenants will use the apartment and after a few years, there will be drainage issues. Likewise, the walls will get weak especially if it is in a region that encounters extreme weather. Furthermore, the paint will also wear off and there might be damage to the walls and ceiling.

So if you sell this building after all these damages, its value won’t be the same as when you bought it. Therefore, while paying your taxes for this building, you can claim tax deductions through depreciation.

Click here to learn more about property tax depreciation. Furthermore, they will also provide you with an estimate of your depreciation deductions for free. And if you have any questions, you can check out their FAQ section.

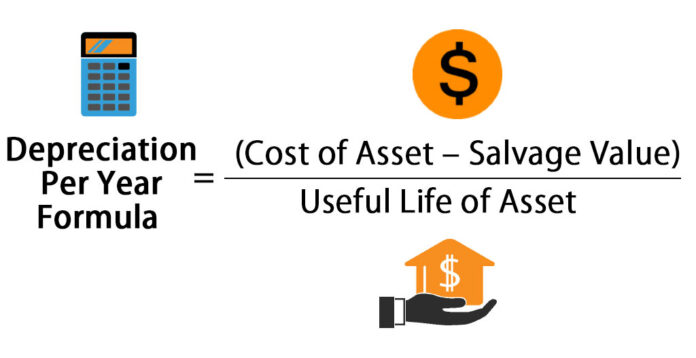

Depreciation calculation

If you want to show that your assets will depreciate over time, there are rules for that. The useful life of your asset plays an important role in determining that whether you can claim for depreciation.

For example, the useful life of an electronic gadget is 2 years. Afterward, you tell them for how long you plan to use that asset. If it is more than 2 years, it means that the gadget will not be of the same price after time. Furthermore, once you start using it, its value decreases continuously. Therefore, you should not pay all the taxes.

You will determine the time to depreciate something.

For example, you bought a new headset that has a useful life span of 2 years. However, you know how much you will use it and it might become useless after 6 months. Therefore, while claiming for your tax reduction, you can also decrease the depreciation time.

This is just an example. There are different classes for different assets. Businesses have a different class and property has a different one. Businesses have to pay a lot of taxes because of their high income. However, if you can prove that your business won’t be this smooth over time, you can pay fewer taxes.

For example, you are starting a business to create plastic products for daily use. However, there is a high chance that within or after a few years the government will ban plastic products. Thus, you can say that your company will depreciate over time. This is to tell the relevant department that your business will work for a short time. Therefore, you are not liable to pay the same number of taxes as Apple pays.

After all, their business has the likeability to grow and make more profits.

What comes under depreciable assets?

There are set guidelines that everyone has to follow. And there are set standards that will determine whether your asset is depreciable or not. So if you want to claim depreciation, you should meet the following criteria;

- You must be the owner of the asset

- Your asset is for a commercial or profitable business. It can either be a house that you buy just to resell it after a time. Or an apartment building that you will rent out to earn profits. Or it can be your business.

- You will tell the useful life of your asset.

- The useful life should be at least more than 1 year.

The items or assets that you can depreciate include;

- Any of your business that you start to earn profits

- Your vehicles

- Computers

- Office furniture

- Other equipment

- Real estate

Your depreciation schedule

Another important thing that you should take care of is the schedule of depreciation. This will show the devaluation of your assets over the time period.

The information that must be included in the schedule include;

- Describe your asset i.e. office, commercial building or house.

- Date when you purchased the asset

- The total amount that you have paid for your asset

- For how long do you think it will be useful to you? i.e. its useful life.

- The depreciation method that you have choose

- If the asset passes its useful life, how much you will get for it if you sell it afterward? For example, you have used the headphones for a year. So after 1 year, how much a buyer would pay you for that?

Different methods of depreciation

The methods that we commonly use are 5. You can choose to use any one of them that seems easier to you.

1 – Straight-line depreciation

This is the most common method that people use.

2 – Double-declining depreciation

It is for the assets that lose their value quickly. For example, vehicles and computers.

3 – Sum of the year’s digits deprecation

This method is for the items that depreciate quickly during the early years. This method is not much common.

4 – Units of production depreciation

This method is most suitable for companies that have a production business.

5 – MACRS

This method is needed for tax returns, where your asset will follow a certain asset class. Thus, the authority will determine its useful life.