What are Some Tips for Securing the Best Car Loan Interest Rate?

Before you sign on the dotted line and purchase a new car, it is important to shop around and search for the right vehicle that fits your lifestyle, budget, and needs. You can finance your vehicle through a dealership, credit union, bank, or an online lender.

Are you searching for some tips for securing the best car loan interest rate? Here’s what you need to know about securing the best interest rate:

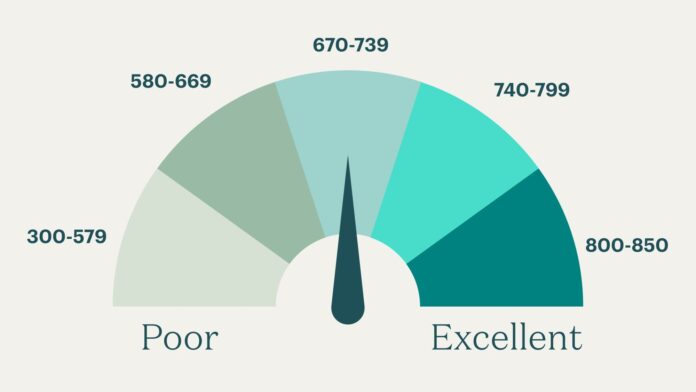

Credit Score

Before you can begin your search for a new car, it is important to raise your credit score and improve your financial situation. It will be difficult to get a decent interest rate for any type of loan if you have a bad credit score! In order to improve your credit score, you will need to learn more about the specific factors that affect it.

Payment history and credit utilization are the biggest factors that impact your credit score, so if you miss payments and carry high balances on your accounts, you can expect to have a lower score. Prioritizing your loan payments and decreasing the amount of debt you have are the first steps to raising your credit score.

Plan for a Down Payment

If you need to finance your new vehicle, you should plan ahead and save for a large down payment – the more you can save, the better! In general, a larger down payment translates into a lower interest rate and better loan terms.

Shop Around

Don’t just settle for the first offer you get! Be proactive and shop around for the best interest rate. You should compare multiple rates from different lenders and make the best choice for your financial situation.

If I Apply with a Co-Signer, Can I Secure a Better Car Loan Interest Rate?

Yes and no. You will only be able to secure a better car loan interest rate if your co-signer has a decent credit score. Otherwise, they will not be able to help you with securing the most reasonable interest rate. One of the most useful tips for securing the best car loan interest rate is to co-sign with a trusted friend or family member that has a strong financial history and prime credit score.

What is the Best Interest Rate For a Car Loan?

The best car loan interest rate would be 0.0%, but unfortunately, that is not a realistic interest rate. Applicants with prime credit scores can typically expect to secure a 5.82% interest rate for a new car, while applicants with subprime credit scores generally receive a 10.79% interest rate on average for a new vehicle.

That is one of the main reasons why it is imperative to improve your credit score before you head to a local dealership to purchase a new vehicle. Work on your finances first, and then secure your new car, or if you already have a car, you can refinance your loan with something called car title loans, which is like an equity loan for cars.

Can You Negotiate a Better Interest Rate?

Yes, you may be able to negotiate a better interest rate at a dealership. Many dealerships and automotive representatives will prioritize a sale and may be willing to compromise. This may not always be the case, but it is worth a shot to try!

Before you try to negotiate with a car dealership, however, it is absolutely necessary to do your research. Do not enter into negotiations with a sales representative that intimidates you! It is best you learn some useful information about negotiating with a dealership.

One of the best tips for securing the best car loan interest rate is to do your due diligence and visit a few different dealerships before you sign a loan agreement.

What Can I Say to Lower the Price of the Car?

Whether you are purchasing a new or used car, it is common knowledge in the car industry that dealers will mark up vehicles in order to make a profit. They keep their business afloat by selling vehicles at a higher price than they paid for them.

However, this also means that they may be willing to lower the price of the vehicle. Whether you are negotiating a lower interest rate or a lower vehicle price, you will need to go into the sale with a plan. Identify the market value of the vehicle you intend to purchase, and use that to negotiate a fair price!

Explore Credit Union Options

When seeking the best car loan interest rate, don’t overlook the advantages of credit unions. Credit unions are member-owned financial institutions that often offer attractive interest rates and borrower-friendly terms. By becoming a member of a credit union, you gain access to their car loan offerings, which can be more competitive than those provided by traditional banks or dealerships.

Credit unions prioritize their members’ financial well-being and may be more willing to work with you to secure a favorable interest rate. Additionally, credit unions often provide personalized customer service, assisting you in finding the best loan option tailored to your specific needs and financial situation. Explore credit union membership opportunities in your area and take advantage of the potential benefits they offer for securing the best car loan interest rate.

Keep Loan-to-Value (LTV) Ratio in Mind

Understanding the significance of the LTV ratio empowers you to strategically manage your car loan. A lower LTV ratio not only increases your chances of securing a better interest rate but also decreases the lender’s perceived risk, potentially leading to more favorable loan terms overall. Before finalizing your car purchase, carefully evaluate your budget and financial capabilities to determine the maximum down payment you can comfortably afford.

By considering the LTV ratio, you can take proactive steps to minimize the loan amount and position yourself for a lower interest rate. Remember that a strong down payment demonstrates financial responsibility to lenders and signals your commitment to repaying the loan, both of which can positively influence your eligibility for a better car loan interest rate.

Conclusion

Securing the best car loan interest rate requires a proactive and informed approach. Take the necessary steps to improve your credit score before embarking on your car search. Plan for a substantial down payment, as it can lead to a lower interest rate and better loan terms. Don’t settle for the first offer you receive; instead, shop around and compare rates from different lenders to find the most competitive option.

Consider the benefits of credit unions, which often offer attractive interest rates and borrower-friendly terms. By becoming a member, you gain access to their offerings and personalized customer service. Additionally, keep the loan-to-value (LTV) ratio in mind. Minimizing the loan amount through a larger down payment or choosing a less expensive vehicle can improve your LTV ratio and increase your chances of securing a better interest rate.