In today’s financial landscape, borrowing money has become integral to personal and business finances. As individuals and organizations seek financing options, one common avenue is through variable interest rate loans.

These loans present both opportunities and challenges for individuals, businesses, and even financial institutions. As economic conditions shift and interest rates rise or fall, borrowers face uncertain futures, making it imperative to develop effective strategies for navigating this volatile terrain.

By understanding the dynamics of variable interest rates, assessing potential risks, and implementing proactive measures, borrowers can safeguard their financial well-being and make informed decisions.

Understanding Variable Interest Rate Loans

Variable rate loans are a borrowing arrangement in which the interest rate fluctuates over time. It’s essential to clearly understand these loans and the factors that influence their interest rates.

Several factors contribute to the volatility of interest rates in variable-rate loans. Economic conditions, such as inflation, economic growth, and monetary policy decisions by central banks, can impact interest rates.

Additionally, market forces, including supply and demand dynamics, investor sentiment, and global economic trends, play a significant role in determining interest rate movements.

It’s crucial to recognize that these factors are subject to change, and the interest rates on variable-rate loans can increase or decrease accordingly. The flexibility of variable-rate loans can be advantageous or disadvantageous depending on the borrower’s circumstances.

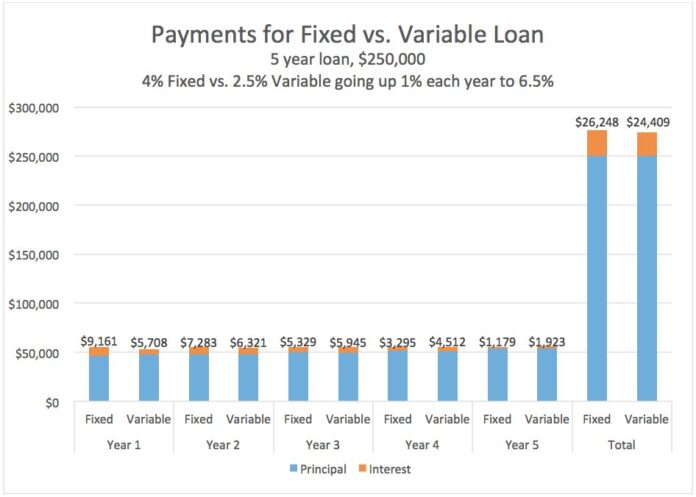

When the interest rates are low, borrowers can benefit from lower monthly payments and potentially save money over time. However, borrowers may face higher monthly payments and increased costs if interest rates rise.

Borrowers considering variable-rate loans should carefully evaluate their financial situation and risk tolerance. It’s essential to understand how the loan’s interest rate is calculated, including the index used, the margin added to the index, and any caps or limits on rate adjustments.

Risk Mitigation Strategies

Managing variable interest rate loans requires a proactive approach to mitigate potential risks. By implementing effective strategies, borrowers can minimize the impact of interest rate fluctuations on their finances. Here are some key strategies to consider:

Thorough Research and Analysis

Borrowers can make more informed decisions and mitigate potential risks by conducting comprehensive research and analysis before obtaining a variable interest rate loan. Here are some things to consider:

- Historical Interest Rate Trends: Look at how interest rates have fluctuated over time and assess the frequency and magnitude of those fluctuations.

- Economic Indicators: Inflation, GDP growth, employment rates, and central bank policies can impact interest rate movements.

- Market Forecasts: Financial institutions, economists, and market analysts often provide forecasts on interest rates.

- Risk Assessment: Evaluate your ability to absorb potential increases in monthly payments and overall costs. Consider your long-term financial goals and whether a variable-rate loan aligns with your risk appetite.

- Loan Terms and Features: Review the loan agreement carefully, paying attention to details such as the index used for rate adjustments, the frequency of adjustments, and any caps or limits on rate changes.

- Consult with Experts: They can provide personalized guidance based on your financial situation and goals. These experts can explain complex concepts, answer your questions, and help you make an informed decision.

Create a Risk Management Framework

Developing a robust risk management framework is essential for managing variable interest rate loans. This framework should include clear policies, procedures, and guidelines for assessing and mitigating risks. It helps ensure consistency and transparency in decision-making and facilitates effective risk monitoring and control.

Utilizing Risk Hedging Tools

Risk hedging tools can help borrowers protect themselves against interest rate fluctuations. Some standard hedging instruments include:

- Interest rate swaps: These financial contracts allow borrowers to exchange fixed-rate payments for variable-rate payments, or vice versa, with a counterparty. Swaps help reduce the exposure to interest rate volatility and provide greater stability in loan repayments. By utilizing interest rate swaps, borrowers can effectively manage their exposure to interest rate volatility and ensure stability in loan repayments.

- Interest rate caps and floors: Caps set an upper limit on the interest rate, while floors establish a minimum interest rate. These options protect against extreme interest rate movements, ensuring that loan payments remain within a predetermined range.

- Collars and options: Collars combine caps and floors to create a range of acceptable interest rates. Options, such as interest rate call and put options, provide flexibility in managing interest rate risk. These hedging instruments offer varying levels of protection and can be tailored to suit specific risk preferences.

Establishing a Contingency Fund

Building an emergency fund is an effective risk management strategy. By setting aside funds designated to handle potential rate increases, borrowers can mitigate the impact on their finances. This fund acts as a buffer, ensuring that borrowers can continue making loan payments even during increased interest rates.

Regularly Monitoring and Reviewing Loan Terms

It’s crucial to stay informed about changes in interest rates and regularly review the loan terms. By keeping a close eye on interest rate fluctuations, borrowers can assess the impact on their loan repayment and make necessary adjustments. It may involve refinancing or negotiating loan terms with the lender.

Communicating with Lenders and Financial Advisors

Seeking professional guidance is highly beneficial when managing variable interest rate loans. Lenders and financial advisors can provide valuable insights and advice on loan management strategies.

They can help borrowers navigate the complexities of interest rate fluctuations, explore refinancing options, and negotiate more favorable loan terms.

Implementing these strategies can significantly reduce the risks associated with variable interest rate loans. By staying proactive, borrowers can better manage their finances and ensure stability in the face of changing interest rates.

Refinancing Options

Refinancing can be an effective strategy to manage interest rate risk. Consider the following options:

- Fixed-rate conversion: Converting a variable-interest-rate loan into a fixed-rate loan provides stability and certainty in loan repayments. This option is advantageous when interest rates are expected to rise significantly.

- Partial refinancing: Instead of fully refinancing the loan, borrowers can refinance a portion of the loan amount at a fixed rate. This strategy allows borrowers to retain exposure to potential interest rate decreases while protecting against interest rate increases.

Final Thoughts

Mitigating risk in managing variable interest rate loans requires diligent risk assessment, appropriate hedging strategies, refinancing options, and ongoing monitoring. By employing these strategies, lenders and borrowers can confidently navigate the dynamic landscape of variable interest rates and achieve their financial goals.